How to Find a Premium Wood grain Vinyl Decorative Films Supplier

- Giwett

- Nov 12

- 5 min read

Updated: Nov 19

Middle East B2B Buyer’s Guide

Choosing the right woodgrain vinyl—also called decorative film or lamination film—directly affects your margin, installation speed, compliance risk, and customer satisfaction. If you operate in the GCC or wider Middle East as a distributor, fit-out contractor, hospitality supplier, or furniture/door factory, this guide gives you a practical, persuasive, and search-friendly path to shortlist, verify, and lock in a premium partner.

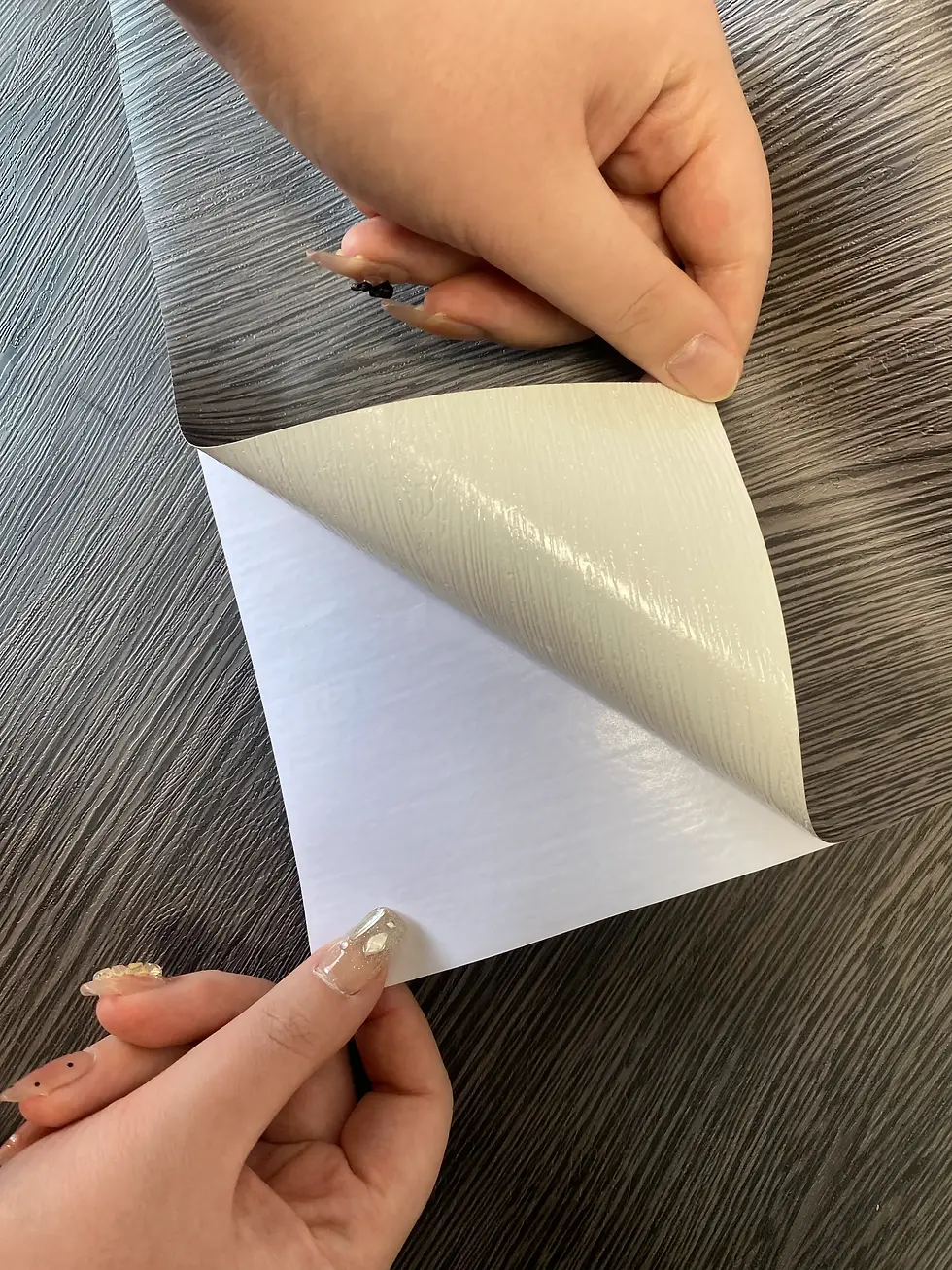

Understanding Decorative Films

Decorative films are engineered surface materials—typically PVC-based—that deliver realistic wood textures, stable color, and protective performance on substrates such as MDF, HDF, particle board, metal sheets, and interior panels. They’re printed, coated, and embossed to mimic natural grain and then laminated or wrapped onto components (doors, casework, wall panels, profiles). The payoff: a consistent look, predictable supply, easier maintenance, and lower lifecycle costs than natural veneer or solid wood in many commercial settings.

Common Types and Best-Fit Uses

Film Type | Typical Thickness & Build | Best Uses | Notes for Buyers |

Woodgrain PVC (printed + embossed) | 70–200 μm; protective topcoat | Doors, cabinets, wall panels | Balance of realism, durability, and cost |

Solid/Metallic PVC | 60–150 μm | Retail fixtures, office systems | Clean color fields; check gloss stability |

Soft-Touch / Anti-Fingerprint | 100–200 μm; special topcoat | Premium hospitality, executive casework | Tactile feel; verify stain/cleaning data |

Profile-Wrapping Film | 60–120 μm; tuned release/primer | J-profiles, trims, edges | Prioritize adhesive/primer compatibility |

Who This Guide Is For

Building Material Distributors: Need broad, replenishable SKU libraries, showroom-ready samples, and stable replenishment cycles to prevent stockouts and dead stock.

Interior Fit-Out Contractors (A-Tier): Aura, Al Tayer Stocks, Khansaheb and peers require compliant documentation, stable lead times, and zero shade drift across phases.

Hospitality Suppliers: Must pass operator audits (fire/VOC), withstand maintenance chemicals, and offer cleanability and scratch resistance.

Furniture, Door & Cabinet Factories: Films must run cleanly on lines (flat lamination, membrane/vacuum press, profile wrapping), with consistent emboss depths and adhesive systems that match substrates and process windows.

What “Premium” Really Means (Beyond Price Per Meter)

A premium woodgrain vinyl supplier shows depth and discipline across: (1) integrated process control (base film → printing → coating → lamination → embossing), (2) color/texture stability with documented ΔE tolerances, (3) performance (scratch, stain, UV, humidity), (4) application fit for your machines and adhesives, (5) documentation & traceability (lot coding, retention samples), and (6) supply reliability (fast sampling, flexible MOQs, and predictable replenishment). The right partner reduces rework, speeds installation, and safeguards your brand on every project handover.

Compliance & Documentation in the GCC (What Consultants Ask For)

Align early with authority and operator expectations. Fire classification often references European or project-specific benchmarks; VOC/IAQ data is increasingly requested; chemical disclosures may be required for project files; and basic import conformity is essential.

GCC Compliance & Market Access Matrix

Topic | UAE | KSA | Qatar / Kuwait / Oman / Bahrain | What to Request from Supplier |

Fire Behavior (project-specific) | Consultant-driven (e.g., EN 13501-1 targets) | Consultant or project spec | Similar consultant-led requirements | Recent classification on your full assembly (substrate + adhesive + film) |

VOC / IAQ | Often required in hospitality/office | Growing focus | Emerging in premium projects | Emission reports; cleaning/maintenance compatibility notes |

Chemical Scope | REACH-style declarations common | As requested by buyer | As requested by buyer | Phthalate strategy; heavy metal limits; safety datasheets |

Import Conformity | Standard import docs | SABER/SASO for finished goods as applicable | Standard import docs | Readiness to support local paperwork and traceability |

(Tip: Premium partners don’t just email PDFs—they help map test data to your actual build-up and provide guidance for mock-ups and site trials.)

Specs to Request (So Your RFQ Gets Accurate, Comparable Quotes)

Ask for: base film type/thickness; print method; topcoat type; surface energy; adhesive/primer chemistry and gsm; emboss name and depth (± tolerance); gloss/matte units; scratch/abrasion/stain data; heat/humidity/UV aging; ΔE tolerance policy vs. master standard; recommended lamination/wrapping temperature/pressure/speed; storage/shelf life; rework/repair guidance. The more precise your RFQ, the fewer surprises during trials and site handover.

Ready-to-Send RFQ Subject: RFQ — Premium Woodgrain Vinyl for Doors/Cabinets (GCC Projects)Include: technical data sheets; compliance docs; ΔE policy; emboss/gloss options; process window; sampling lead time; MOQ; mass-production lead time; replenishment plan; pricing at volume tiers and Incoterms to your port/city; two case studies and three Middle East references.

Due Diligence in 7 Steps (From Samples to Scale)

Shortlist 8–12 SKUs aligned to regional tastes (oaks, walnuts, ash, teak).

Sample Realism: A4 swatches + A3 boards + 2–3 m rolls for realistic trials.

Run Line Trials: Record speed/temperature, edge wrapping, wet-out, post-cure.

Color Lock-In: Approve a physical master panel; require batch ΔE reporting.

Pilot PO: Low MOQ with incoming/in-process/outgoing QC checkpoints.

Site Mock-Up: Stress-test cleaning chemicals; secure consultant/operator sign-off.

Scale & Replenish: Agree safety stock and communication cadence before rollout.

Supplier Scorecard (Copy/Paste into Your SOP)

Criterion | Weight | What “Premium” Looks Like | Your Score |

Process Depth (R&D→Emboss) | 15% | In-house control; documented SOPs | |

Color/Texture Stability | 15% | ΔE controls; retained standards; batch reports | |

Performance Package | 15% | Scratch/stain/UV/humidity data | |

Application Fit | 15% | Constructions tuned to your lines & substrates | |

Compliance Docs | 10% | Current fire/VOC/chemical declarations | |

Sampling → Scale | 10% | 48-hour samples; stable mass production | |

Logistics & MOQs | 10% | Flexible MOQs; clear replenishment SLAs | |

Technical Support | 10% | On-site/remote guidance; failure analysis | |

Total | 100% |

Total Cost of Ownership (Why the “Cheapest Roll” Can Cost More)

Price per meter is only one variable. Add scrap rates observed in trials, installation hours, rework/warranty visits, delay penalties, and the cost of color mismatches across phases. A film that installs 10% faster and reduces rework 2% often beats a cheaper alternative at project scale—especially when timelines are tight and consultant approvals are at stake.

Patterns That Convert in the Middle East (And Keep Converting)

Light neutral oaks for minimal, modern hospitality and residential.

Rich walnuts/teak to add warmth in lobbies, F&B, and corridors.

Ash/elm straight grains for offices and retail systems.

Soft-touch matte + anti-fingerprint for premium doors and casework.Optimize your metadata and internal links around: woodgrain vinyl, wood grain PVC film, decorative film supplier, lamination film for doors/cabinets, OEM/ODM supplier + Dubai/UAE/Riyadh/KSA/Doha/GCC + wholesale/bulk/project supply.

Why Many Middle East Buyers Choose Giwett

Integrated production (R&D, printing, lamination, coating, embossing) gives tight control over color and texture. Application-driven formulas are tuned for flat lamination, membrane pressing, profile wrapping, and steel lamination. Fast sampling and flexible MOQs accelerate pilots; discipline in QC and documentation (retention samples, ΔE policies, and third-party testing upon request) streamlines consultant approvals and repeat orders.

FAQs (Concise Answers for Faster Decisions)

Q1: What fire rating is “enough” for hotel doors or retail fixtures?A: Requirements are consultant-specific. Ask for recent classifications on your full assembly and confirm acceptance with the authority having jurisdiction.

Q2: Can one supplier cover flat lamination and profile wrapping?A: Yes—request tailored constructions (adhesive gsm, primer, release) and validate on your lines.

Q3: How do we avoid shade variation across phases?A: Approve a physical master, maintain a replenishment archive, and require batch ΔE reports.

Q4: What MOQs are realistic for pilots?A: Premium partners support low MOQs with 48-hour sample dispatch to de-risk selection and scaling.

Comments